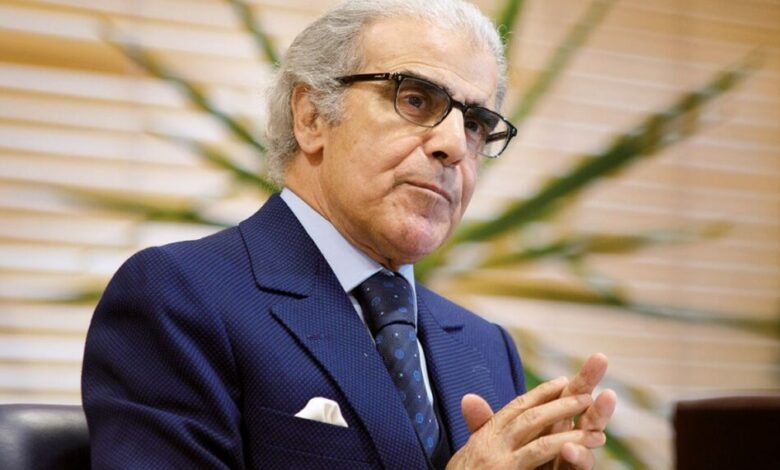

Bank Al-Maghrib keeps its key Rate Unchanged at 3%

Taking into account the delays in transmitting its decisions to the real economy, the Board thus decided to mark a pause in the monetary policy tightening cycle, said BAM in a statement issued at the end of its second quarterly Board meeting for the year 2023.

The Board’s decisions at its forthcoming meetings will take into account, in particular, an in-depth, updated assessment of the cumulative effects of its rate hikes and the impact of the various measures introduced by the government to support certain economic activities and household purchasing power.

At this meeting, the Board examined and approved the annual report on the country’s economic, monetary and financial situation, as well as the Bank’s activities for the 2022 financial year.

It then analyzed the evolution and outlook for the world economy, which remains surrounded by considerable uncertainty, particularly in view of the implications of the conflict in Ukraine, added the same source, stressing that it noted, in particular, that inflation in the main advanced economies is gradually declining, driven by the fall in energy and food prices, but still remains well above central bank targets.

At national level, the Board reviewed recent economic developments and examined the Bank’s medium-term macroeconomic projections. It noted in this respect that, after a rate of 6.6% in 2022, inflation continued to accelerate, reaching a peak of 10.1% in February 2023.

ALdar : LA MAP